Generally, the maximum amount of rent you can afford is deduced from your yearly income. The rule of thumb is usually that you should pay no more than 25-30% of your before-tax income. However, that number can change based on various factors and expenses that you must consider for yourself.

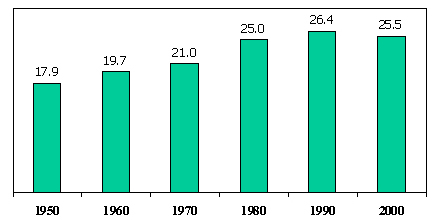

Take a look at this chart from the Census Bureau that demonstrates the how the gross rent as the percentage of income has grown between 1950 and 2000:

Note: Income of Families and Primary Individuals for 1950-1970; household income for 1980-2000

Source: U.S. Census Bureau, Census of Population and Housing, decennial volumes.

There are some very important things to consider when you are figuring out how much rent you can afford. For instance:

CAR PAYMENTS/TRAVELING COSTS

Do you own a car or rely on public transportation? Either way, there are important things to take into account derived by your preferred mode of transportation.If you own a car there are often car payments to consider. How much a month must be allocated towards making these payments?

Furthermore, if you commute to work or drive frequently, you must also remember to include your gas bills. With the price of gasoline approaching $3.50 these days, gas costs can put a huge dent in your wallet.

Even if you don't have a car, many people must rely on alternate modes of transportation like the bus, subway system, or taxicabs. Unfortunately, all of these things cost money, so it is important to take into account the average amount of money you spend on getting around. Also if public transportation is you main mode of moving about a city you want to be sure that you rent a home that is located close enough to a bus stop.

FOOD

Everyone must eat, but how each person eats can make a huge difference. How frequently you eat out versus preparing your own food really affects how much money you will be able to put towards rent each month. If you are prone to feasting out 7 days a week, make sure you note your additional costs!ENTERTAINMENT/ SOCIAL CATEGORIES

It's easy to forget to take into consideration how much you spend on entertainment costs and social events each month. Unfortunately, for many people, this is where a great deal of their income is spent.Do you enjoy going to the movie theaters or renting movies?

How often do you go to bars and nightclubs? Do you order the $3 beers or the $10 Manhattans?

MISCELLANEOUS

Oh how easy it is to forgot to take into account your "other" costs. If you are in the habit of spending $1000 a month on your wardrobe, you obviously will not have that money available to put toward ensuring that the roof over your head remains over your head.Now, I focused on possible costs that you may have each month to show that you must take more than simply a static percentage of your income into account. But, obviously, if YOU have a very low cost of living and do not spend that much, you have more money to pay rent with.

When deciding how much rent you can afford each month, you simply must take into account all of your other expenses. Furthermore, it matters greatly whether you are trying to save money or are content to living "pay check to pay check."

iDeal Realty & Management

9051 W Kelton Lane, Suite 10

Peoria, Arizona, 85382

623-201-3544

These are great information! I didn't know how to actually forecast the amount of rentals that I should have, especially now that I'm planning to get some used trucks in calgary for my poultry business. Thanks for sharing these information.

ReplyDelete